See How Much You Could Lower Your VA Mortgage Payment

Claim Your New Lower Rate today!

Arizona Veterans may qualify for lower payments with no appraisal, no income verification, and no money out of pocket.

Arizona Veteran Refi

We’re here to help Arizona Veterans understand and access the powerful VA loan benefits they’ve earned — including the IRRRL refinance program, designed to lower payments quickly and make homeownership more affordable.

Streamlined Application Process: 10 Minute Application & next day approval. We strive to close your new loan in 14 days or less to lock in savings before you next payment!

Personalized Loan Options: We tailor your loan options to your needs. Faster Payoff or lower payment -- whatever serves you best!

Clear, Transparent Guidance: We win when you win. We'll walk you through if it's worth refinancing, and what your payback period is.

Enhanced Customer Experience: You'll Receive the personal cell phone number of one of our loan officers to ensure that you're always in the know.

no Out of pocket expenses: we're here to help you financially - which means keeping your hard earned money in your pocket. no out of pocket expenses required.

Frequently Asked Questions

What documents do I need to refinance my VA Loan?

This is a light documentation loan. All we need is:

- A copy of your government issued ID

- A recent mortgage statement

- A copy of your home insurance policy

- A payoff for your current mortgage

How long does the process take?

VA IRRRL loans are streamlined. Our team routinely closes them in 7-10 business days.

Can I Get Cash Out?

VA IRRRL Loans Do not allow for cash out aside for incidentals up to $500. However, We do have cash out options. Please ask your loan officer to explain.

What if my credit or Job changed since I got my loan?

Since VA IRRRL loans don't require income to be considered when qualifying, it generally doesn't matter if your job has changed -- as long as you're current on your payments.

A higher credit score can mean better rates, so we recommend at least a 580 score to qualify, but can work with lower scores.

Testimonials

"Josh Was Excellent. He did my purchase loan and called me when it was time to refinance. We saved almost 2% which led to $100's per month saved. Plus I got a $500 check after closing and got to skip two mortgage payments! "

— Anthony P.

"I was skeptical at first. But the AZ Refi team talked me through the process and laid everything out in clear terms as soon as I applied. One week later I was signing new VA loan documents that led to me saving over $200/mo. Now I don't have any payments until the new year. He even had one of his insurance partners reach out to me which saved me even more monthly. They're the real deal!"

— Christopher M.

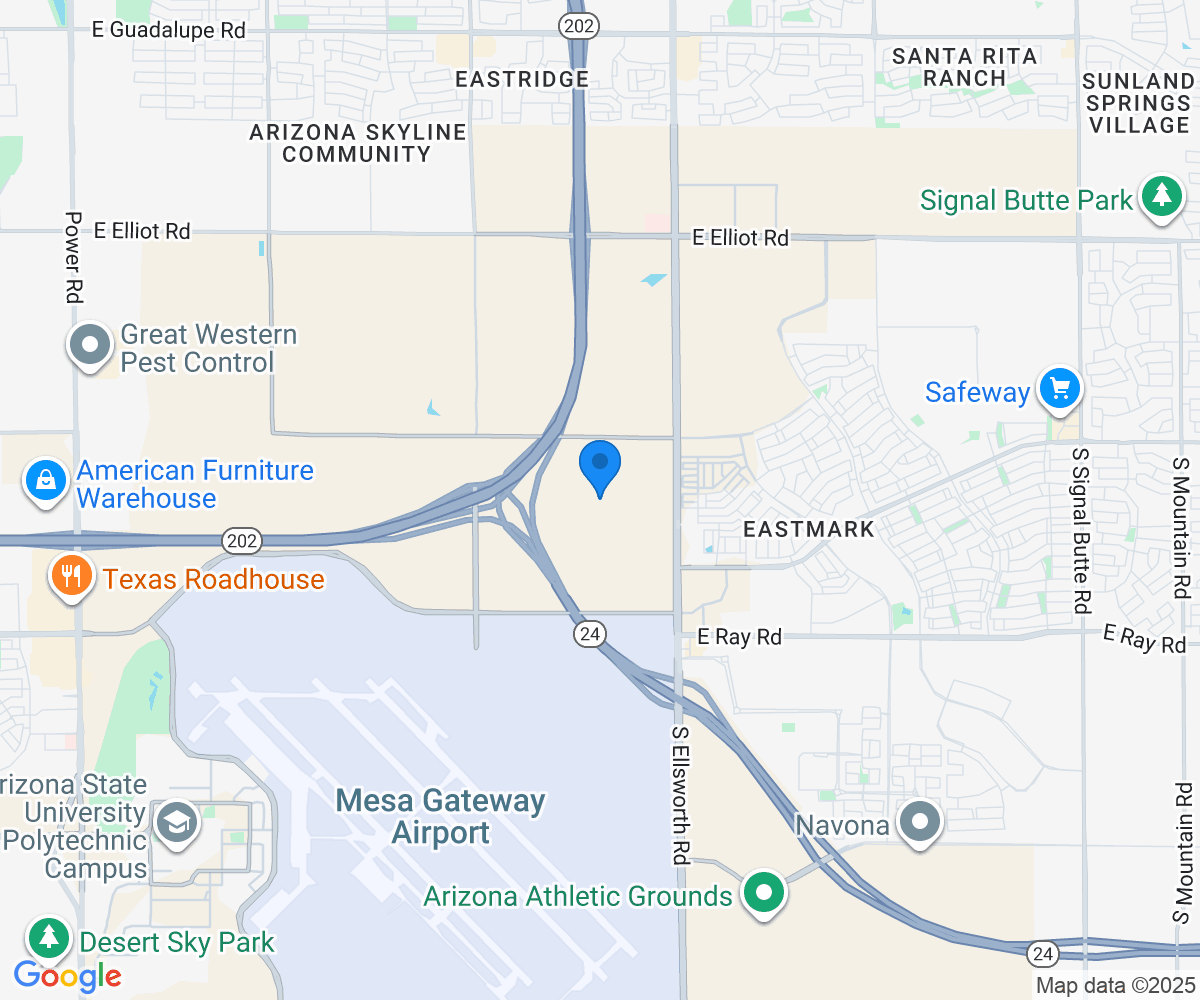

Location: 4026 s Helios, Mesa Arizona 85212

Call (480) 454-0975

Email: [email protected]

Site: AZVeteranRefi.com

© Copyright Arizona Veteran Refi 2026. All rights reserved.

Privacy Policy | Terms of Service

Joshua Sprague, NMLS 2278722 is a Licensed Mortgage Broker for Bullfrog Financial LLC DBA AZ Veteran Refi

Equal Housing Lender: *Savings vary. Josh Sprague | NMLS #2278722 | Bullfrog Financial Powered by Barrett Financial Group, L.L.C. | NMLS #181106 | 275 E Rivulon Blvd, Suite 200, Gilbert, AZ 85297 | AZ 0904774 | IN 181106 | Equal Housing Opportunity | This is not a commitment to lend. All loans are subject to credit approval. | nmlsconsumeraccess.org/EntityDetails.aspx/COMPANY/181106